Mortgage value calculator

To determine your home equity simply take your current property value and subtract the outstanding loan balance. Before you start punching numbers into a calculator however you need to have a budget.

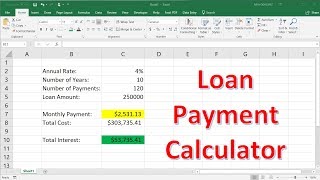

Simple Loan Calculator

It is best to use a calculator put in the value to be raised than press the xy button and enter the n.

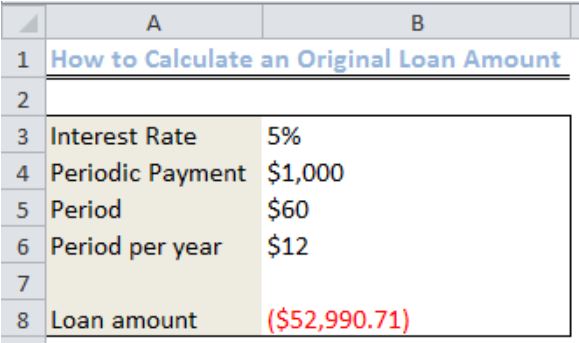

. Present value is compound interest in reverse. This calculator shows your monthly payment on a mortgage. Some lenders can approve FHA loans for borrowers.

Our mortgage calculator is based on conventional loan guidelines that typically cap your DTI ratio at 45 although exceptions are possible to 50. It includes advanced features like amortization tables and the ability to calculate a loan including property taxes homeowners insurance property mortgage insurance. The Loan term is the period of time during which a loan must be repaid.

See How Finance Works for the mortgage formula. See How Finance Works for the present value formula. PMI along with your monthly mortgage payment until your loan-to-value LTV reaches 78-80.

You can also see the savings from prepaying your mortgage using 3 different methods. The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages. Start by inputting your property type estimated home value ZIP code outstanding mortgage balance if applicable and the youngest co-borrowers age if applicable.

An Adjustable-rate mortgage ARM is a mortgage in which your interest rate and monthly payments may change periodically during the life of the loan. A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan. Finding the amount you would need to invest today in order to have a specified balance in the future.

Income If you calculate based on income the calculator will take information about your financial health and loan preferences combined with projected taxes and insurance to provide an estimate. How much can you afford. Among other places its used in the theory of stock valuation.

For example a 30-year fixed-rate loan has a term of 30 years. Buying a house is the largest investment of your lifetime and preparation is key. The amount you pay in property taxes is based on a percentage of your property value which can change from year to year.

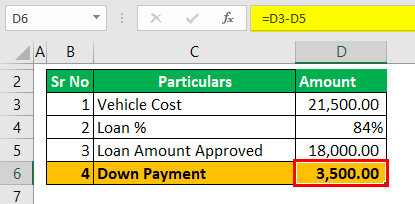

Specifically if the down payment is less than 20 of the propertys value the lender will normally require the borrower to purchase PMI until the loan-to-value ratio. Check out the webs best free mortgage calculator to save money on your home loan today. Youll also need to.

A mortgage calculator helps prospective home loan borrowers figure out what their monthly mortgage payment will be. Mortgage insurance is only available when the purchase price is below 1000000. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules.

See your total mortgage payment including taxes insurance and PMI. You can also sometimes estimate present value with The Rule of 72. Use our mortgage calculator to help you estimate your monthly payments and what you can afford.

The actual amount you pay depends on several factors including the assessed value of your home and local tax rates. A mortgage is high-ratio when your down payment is less than 20 of the property value--Down payment --Tip. Use this mortgage calculator to estimate how much house you can afford.

At the end of each term the mortgage must be renewed for another term at which point there is an opportunity to consider making any changes. A mortgage calculator is a great tool that you can use to see how much you can realistically afford. To use the early payoff mortgage calculator simply enter your original loan amount when you first received the loan along with the date you took out the home loan.

Our reverse mortgage calculator can help you determine how much money you might qualify to receive in a lump-sum payment. With our home loan calculator you can play around with the numbers including the loan amount down payment and interest rate to see how different factors affect your. Then get pre-qualified to buy by a local lender.

To the power of n in our example 240. Use our calculator to get an estimate on your price range that fits your budget along with mortgage details. Most mortgages have a five year term though shorter terms are possible.

Set aside about 2 to 4 of your purchase price for closing. An Adjustable-rate mortgage ARM is a mortgage in which your interest rate and monthly payments may change periodically during the life of the loan. You can avoid this additional monthly cost by putting 20 down on your home.

The Loan term is the period of time during which a loan must be repaid. For your convenience current Redmond mortgage rates are published underneath the calculator to help you make accurate calculations reflecting current market conditions. Chases mortgage affordability calculator creates an estimate of what you can afford and what your mortgage payments may be based on either.

For example if your home is worth 500000 and your loan. Enter the appropriate numbers in each slot leaving blank or zero the value that you wish to determine and then click Calculate to update the page. In just 4 simple steps this free mortgage calculator will show you your monthly mortgage payment and produce a complete payment-by-payment mortgage amortization schedule.

This free mortgage calculator helps you estimate your monthly payment with the principal and interest components property taxes PMI homeowners insurance and HOA fees. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. It also calculates the sum total of all payments including one-time down payment total PITI amount and total HOA fees during the entire amortization.

For example a 30-year fixed-rate loan has a term of 30 years. As your homes value increases ask your lender about options to remove your PMI. Estimate your payment with our easy-to-use loan calculator.

Put a calculator on your site for. Borrower is unable to repay the loan. Choose mortgage calculations for any number of years months amount and interest rate.

Of Annuity Bond Yield Mortgage Retirement. Mortgage calculator - calculate payments see amortization and compare loans. Purchase price Down payment Amortization period number of years 1 Year 2 Years 3 Years 4 Years 5 Years 6 Years 7 Years 8 Years 9 Years 10 Years 11 Years 12 Years 13 Years 14 Years 15 Years 16 Years 17 Years 18 Years 19 Years 20 Years 21 Years 22 Years 23.

How to Use the Mortgage Calculator. Our calculator includes amoritization tables bi-weekly savings. With links to articles for more information.

Almost any data field on this form may be calculated. The five-year mortgage term is the amount of time a mortgage contract is in effect. The taxes portion of your mortgage payment refers to your property taxes.

No personal information is required to calculate your estimate. Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance. Monthly payment i monthly interest rate as a decimal interest rate per year divided by 100 divided by 12 and PV.

Heres a quick example of how to determine whether you can afford a mortgage assuming your monthly payment. Pop up mortgage calculator. A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan.

Compound Interest Present Value Return Rate CAGR Annuity Pres. Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan and save money on interest. A mortgage payment calculator takes into account factors including home price down payment loan term and loan interest rate in order to determine how much youll pay each month in total on your home loan.

Calculate monthly mortgage payments and amortization schedule based on term interest rate and loan amount.

Excel Formula Estimate Mortgage Payment Exceljet

Va Mortgage Calculator Calculate Va Loan Payments

How To Calculate Loan Payments Using The Pmt Function In Excel Youtube

Simple Mortgage Calculator

Advanced Loan Calculator

Excel Formula Calculate Loan Interest In Given Year Exceljet

Mortgage Calculator How Much Monthly Payments Will Cost

Interest Only Mortgage Calculator

Free Mortgage Calculator Free Financial Tools Transunion

How To Calculate Your Monthly Mortgage Payment Given The Principal Interest Rate Loan Period Youtube

Extra Payment Mortgage Calculator For Excel

Mortgage Repayment Calculator

Loan Calculator How To Calculate Periodical Installments

Excel Formula Calculate Payment For A Loan Exceljet

Excel Formula Calculate Original Loan Amount

Mortgage Calculator How To Calculate Your Monthly Payments Valuepenguin

Online Mortgage Calculator Wolfram Alpha